Help to Buy scheme

From 16 December 2020, the Help to Buy scheme has been replaced with a new scheme for first-time buyers of new homes only.

What is the Help to Buy scheme?

The Help to Buy has scheme has changed!

The new Help to Buy 2021-2023 scheme is now in place. Help to Buy is now only available to first-time buyers, due to changes in government legislation. If you’re an existing homeowner wanting to move, you can check out our other helpful purchase schemes.

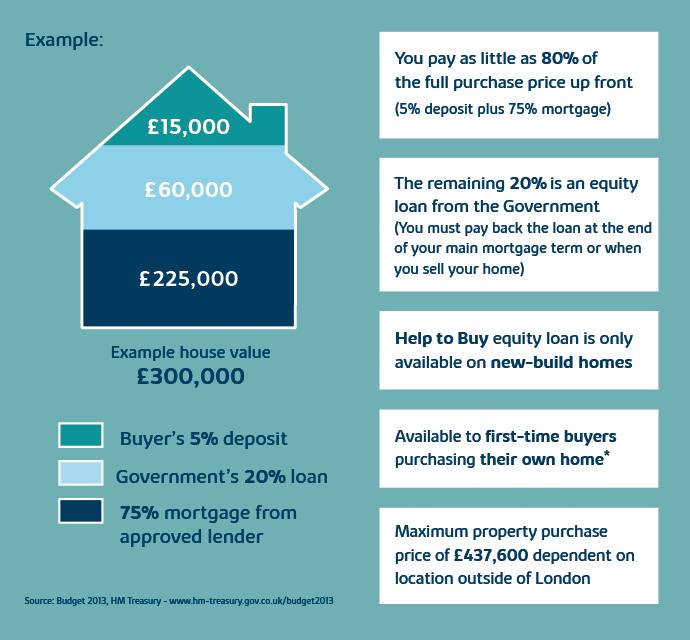

Regional caps are now in place, meaning you can spend between £186,100 and £437,600 on your new home (or £600,000 in London), depending on where it’s located.

How does the Help to Buy scheme work?

The first-time buyer government scheme works to help you buy your new build home sooner. By using the scheme, you’ll need just a 5% deposit as first-time buyers, with the government providing an equity loan of up to 20% of the value of the new home you’re buying (40% in London).

You can then secure up to a 75% mortgage, which opens the door to more competitive lending rates, and may make your repayments more affordable than you first thought.

What’s more, you won’t be charged interest or fees on the government equity loan for the first five years of owning your home under the affordable new build scheme, and you can choose to repay the equity loan at any time without penalty, or upon the sale of your home.

What are the regional price caps for the Help to Buy scheme?

For homes completing after April 2021, the amount first-time buyers can use to purchase a home using Help to Buy in England will depend on where you are buying.

The new price caps vary by region, meaning the amount you can spend on your new home is based on where the house is located. The cap is linked to the general cost of housing in the area, meaning there is a big difference in the price caps between regions.

Use this map to find out what your regional price cap is.

Is the Help to Buy scheme right for me?

The government Help to Buy scheme isn’t suitable for everyone. However, for first-time buyers struggling to get on the property ladder, it can help you realise your dream of home ownership sooner.

Some of the benefits of the Help to Buy scheme include:

- Access to preferential mortgage rates.

- Just a 5% deposit required.

- The government lends you up to 20% of the house value with an equity loan.

- An initial interest-free period of five years on the government equity loan. If you’ve got a growing family or are just starting out in your career, you can get your finances sorted before you’re paying back interest.

- More competitive mortgage deals available with just a 5% deposit to secure.

- Government-backed scheme exclusively for new homes.

- Equity loan can be repaid at any time or on sale of home.

- It can be used with our discount scheme for the serving military.

Keen to find out more about purchasing a new home? Download our first-time buyer guide.

Reasons to choose the Help to Buy scheme with Bovis Homes:

At Bovis Homes, we pledge to help first-time buyers realise their dream of home ownership.

When buying your first property, you may not have much money to spend on renovations. And with one of our new homes, you won’t have to. Forgot costly home improvements and living with dated décor – our new build homes come as a blank canvas, ready for you to put your own stamp on things.

Buying with one of the UK’s leading new home builders means you’ll get a spacious, contemporary property built to an impeccably high standard.

Whether you’re starting a family or just looking to flee the nest, you can relax knowing your new build house was built by the best.

Take the first step with Bovis Homes

If you thought a high-quality, brand-new home was out of reach – think again. Come and speak to one of our sales consultants and let’s see if we can get you moving. It’s all part of our pledge to help first-time buyers get on the property ladder.

Take a look at our handy Help to Buy mortgage calculator to work out your maximum purchase price, mortgage required, and estimated monthly repayments based on the deposit you have available for your new home.

Help to Buy mortgage calculatorFor more information on the Help to Buy - Equity loan, view the Help to Buy Buyers’ Guide. This explains how the scheme works with financial examples, along with details on the buying process.

Help to Buy buyer’s guideFrequently asked questions:

With Help to Buy, you won’t be charged interest or fees on the Government equity loan for the first five years of owning your home. That means lower overall mortgage payments.

With a 5% deposit and the government’s equity loan of up to 20% of the value of the new home, you only need to secure up to a 75% mortgage. This means you may benefit from more competitive lending rates and a wider mortgage choice.

Try our Help to Buy mortgage calculator. Work out your maximum purchase price, mortgage required, and estimated monthly repayments based on the deposit you have available.

From April 2021, Help to Buy will only be available to first-time buyers due to changes in government legislation.

For First-time buyers, Help to Buy can be used in conjunction with our discount scheme for serving military personnel

Help to Buy cannot be used with our Part Exchange scheme but this scheme may be another option for you as a current homeowner – offering a quicker, chain-free move.

No, there are no restrictions on annual household incomes for this scheme.

No, changes to Help to Buy from April 2021 means that only first time buyers will be eligible.

From April 2021 Help to Buy will be available to first-time buyers ONLY due to changes in government legislation. There will also be changes to regional variations in maximum property values. For those who have purchased a home from us before March 2021 the previous Help to Buy scheme will still apply. Please ask us for further details.

Yes – you can pay back the equity loan at any time.

Terms and conditions: The Help to Buy equity loan scheme has specific terms and conditions and is subject to affordability criteria as prescribed by the Homes and Communities Agency. Not to be used in conjunction with any other purchase assistance scheme, offer or promotion. Please ask our sales consultant for details.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP PAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT